This Website allows the sending only of so-called “first-party” analytic cookies to guarantee its technical functioning and to analyse aggregate data on Website visits. By closing this banner, or clicking on any element in the web page, the use of these cookies is accepted.

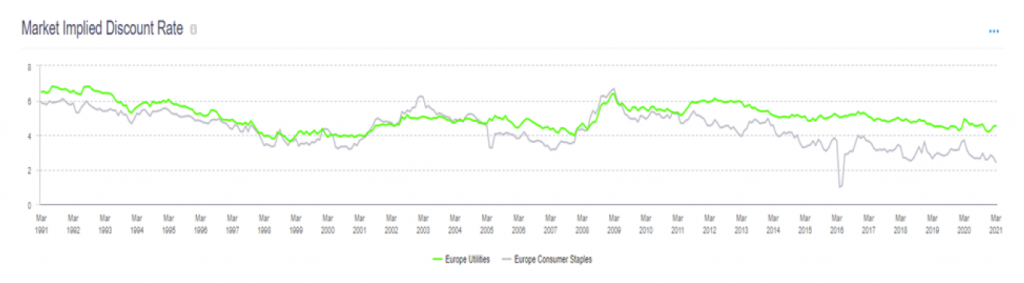

European utilities may be on the cusp of a new phase of significant growth that could last decades due to the expected growth of electricity and renewables in the energy markets. If proved correct, this super cycle could transform some utilities from bond ‘proxies’ into growth stocks. This transformation is not yet reflected in market valuations which continue to value the sector as long-term defensive holdings with modest growth expectations. The sector today continues to trade at a discount still substantially above that of Consumer Staples.

This has also been evident in recent weeks with Utilities penalised due to the risk of rising interest rates. Traditionally, Utilities operate with high leverage and are therefore quite sensitive to any rate hikes that affect their profitability. But will this dynamic persist? We believe not. At Plenisfer, we believe there are at least three reasons for the possible reclassification of some Utilities from lower-risk bond proxies towards growth stocks:

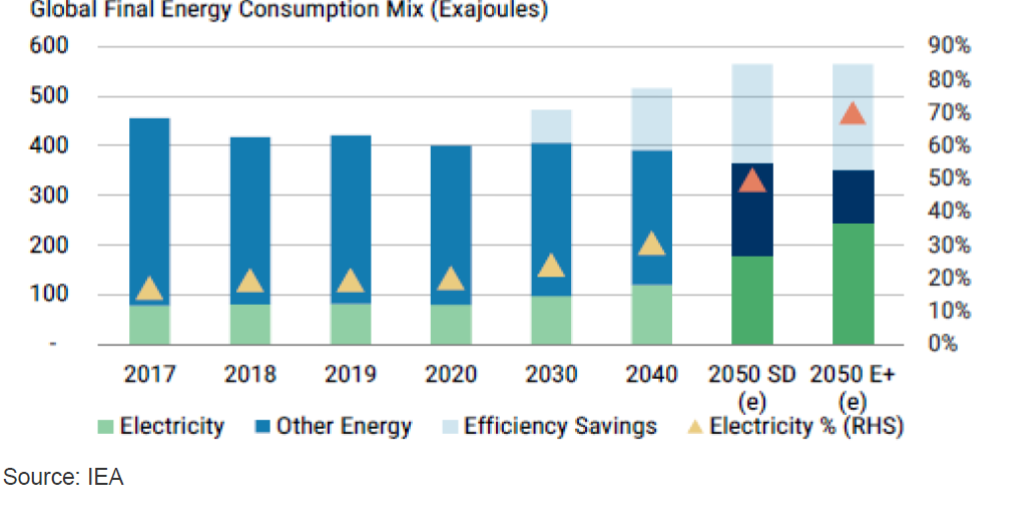

1. Electricity and Renewables are winning the energy battle

Energy transition represents such an enormous growth opportunity with electricity expected to represent about 70% of the energy mix by 2050 v c. 20% today. Energy consultants/agencies forecasts imply a potential range of 11,000 GW to 27,000 GW of additional renewables capacity by 2050. Since the development of 1 GW of renewable energy requires investments of over 1 billion euros (source: McKinsey), investments in the sector can be estimated between 12 and 24 trillion dollars.

Source: IEA

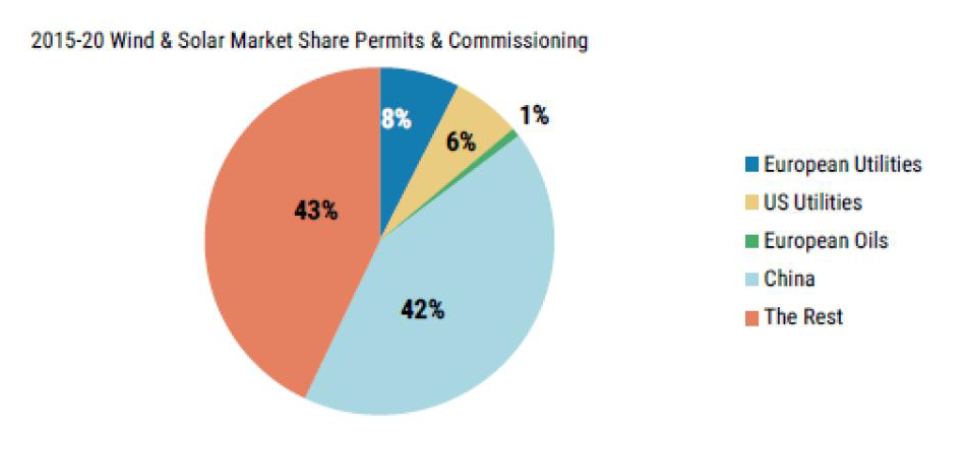

2. A fragmented market ready for consolidation

75% of the renewables market is spread among smaller developers, mostly independent power producers (IPPs) with portfolios of less than 1GW. On the back of tighter credit conditions, a higher cost of capital and a more complex supply chain (owing to COVID restrictions), we expect that in the sector there may be a consolidation process led by large operators who will benefit not only in terms of market shares, but above all in terms of profitability.

Source: BNEF

3. Green Climate Policies now have cross-Atlantic support

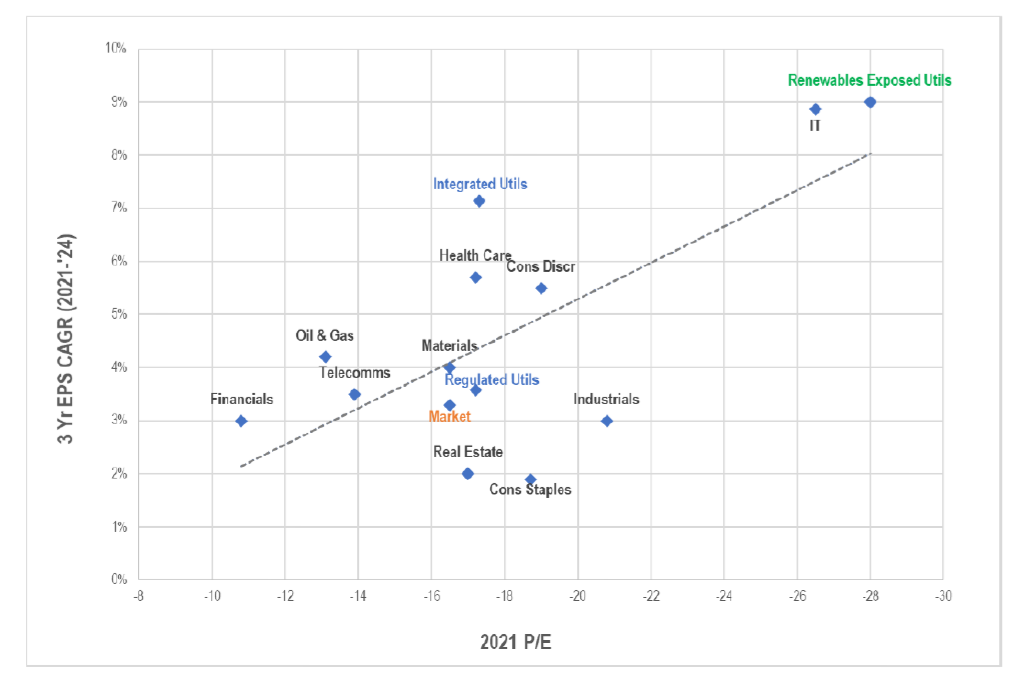

The publication of National Energy Plans to 2030s (NEPs), the disclosure of the EU Recovery Fund (c.30% is for support of Green policies), and the US Climate plan presented by new US President Joe Biden are key support for ‘net zero’ green climate policies. These appear to anticipate an ongoing acceleration of clean infrastructure investments. Rising awareness around the issues of climate change is likely to continue to drive the Decarbonisation theme. For Utilities, this represents a growth opportunity above historical level. We expect the growth drivers of Renewables development and electrification to benefit from policy tailwinds. The growth dynamic of the Decarbonisation theme should warrant higher valuations.

Source: Plenisfer and Bloomberg

Within the sector, the fastest growing Utilities names are those with the most Renewables exposure. This is already delivering higher valuations consistent with these growth levels. In our view, integrated utilities are best positioned to benefit from these trends. They combine the scale required to add value through large-scale investments in Renewables with the low cost of capital supported by their regulated businesses. In addition, such companies pose low counterparty risk for government subsidy regimes. Furthermore, we believe that the integration of customer, network, and generation -both Renewables and Thermal- creates value opportunities throughout the supply chain. Consequently, we expect Integrated utilities to disconnect from the bond proxy dynamic and re-rate to growth multiples. Regulated utilities, in contrast, will most likely remain lower risk bond proxies. We, therefore, expect the divergence between Regulated and Integrated segments to become more pronounced, as materially different investment cases for each emerge. At Plenisfer, we see this as the start of a new distinctive growth phase, with ongoing consequences for valuation. We suspect this new phase could last for a number of years.

Disclaimer

This analysis has been prepared for informational purposes only. This document does not constitute an offer or invitation to sell or buy any securities or any business or business described herein and does not form the basis of any contract. The above information should not be used for any purpose. Plenisfer Investments SGR S.p.A. has not independently verified any of the information and does not release.

No representations or warranties, express or implied, as to the accuracy or completeness of the information contained herein and the same (including their respective directors, partners, employees or consultants or any other person) shall not, to the extent permitted by law, have any liability for the information contained herein or for any omissions arising therefrom or for any reliance that either party may place on such information. information. Plenisfer Investments SGR S.p.A. assumes no obligation to provide the recipient of this document with access to further information or to update or correct the information. Neither the receipt of such information by any person, nor the information contained in this document constitutes, or will be considered as constituting, the provision of investment advice by Plenisfer Investments SGR S.p.A. to such subjects. Under no circumstances should Plenisfer Investments SGR S.p.A. and its shareholders and subsidiaries or their employees be directly contacted in relation to this information.

Plenisfer Investments SGR S.p.A.

Via Niccolò Machiavelli 4

34132 Trieste (TS)

Via Sant'Andrea 10/A, 20121 Milano (MI)

info@plenisfer.com

+39 02 0064 4000

Contact us at info@plenisfer.com

This is a marketing communication. Please refer to the Prospectus and Key Investor Information Document (KIID/KID) before making any final investment decisions. Past performance is no indication of future performance.

The value of your investment and the return on it can go down as well as up and, on redemption, you may receive less than you originally invested.

© Copyright Plenisfer Investments onwards 2020. Designed by Creative Bulls. All rights reserved.