This Website allows the sending only of so-called “first-party” analytic cookies to guarantee its technical functioning and to analyse aggregate data on Website visits. By closing this banner, or clicking on any element in the web page, the use of these cookies is accepted.

Marco Mencini, Senior Portfolio Manager Equity di Plenisfer Investments SGR

Industrial metals have seen strong gains over the last nine months leaving investors wondering whether we are at the start of the next ‘super-cycle’ or is the fiscal-led rebound which began in 2020 getting close to its peak? In our view, the macro and fundamental backdrop for Industrial Commodities remain robust and we expect prices may experience further growth over the next couple of years. The real challenge will be to understand which commodities have long-term potential versus which have just benefited from an imbalance in demand versus supply but lack the capacity for structural growth. Plenisfer’s stance that certain commodities will continue to be supported by robust backdrop and are at the beginning of a new super-cycle, is predicated on a number of factors:

1. Sustained demand growth in China, as shown by the recovery in Chinese demand indicators, and vaccine-led recovery in the rest of the world.

China accounts for >50% of demand for key industrial commodities and remains the dominant driver of underlying commodity demand. The 3key segments of demand are: 1) property/construction 2) infrastructure and 3) manufacturing 4) auto. Although consensus expectations see some moderation in Chinese economic growth in H2 2021, real GDP is still expected to be in the region of 7.5-8% in 2021 and 5% in 2022. In addition, 2021 will also be the first of China’s 14th Five-year-plan and detailed reform plans will be announced this year, which, in our view, should bode well for commodity demand. Any normalisation in China of growth should also be compensated, to some degree, by vaccine-led recovery in the rest of the world.

2. Limited Supply Growth in Base Metals in Next Few Years

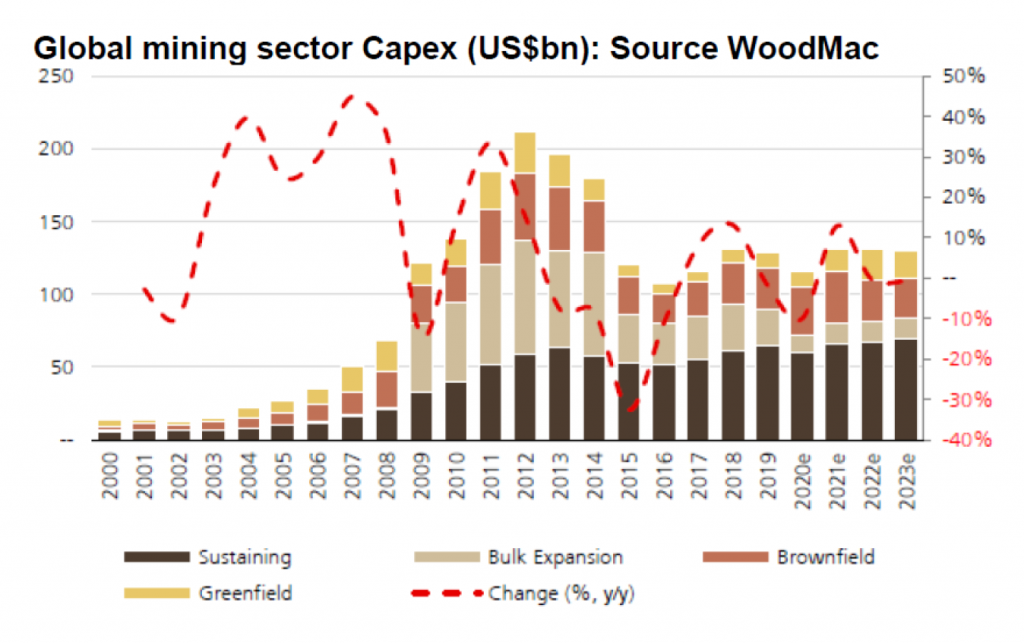

Mining Capex (Capital expenditure) reached an all-time high following the China-driven commodity super-cycle that began in 2003-04 with commodity prices mostly peaking in 2011 and capex peaking in 2012. During that super-cycle, mining companies increased their long-term commodity price assumptions based on a view that urbanisation and industrial development of emerging economies could last many years. In this scenario, projects that had previously been deemed ‘uneconomic’ ultimately became compelling. However, this investment in new capacity led to an increase in supply that drove commodity prices lower, leading to a cyclical downturn in the sector from 2012-15. The perception about investment in growth in mining has dramatically changed following the 2015-16 downturn. Balance sheets have become sacred, and capital returns have become more important than growth. Capital

Capital intensity for mines has tripled over the last 40 years in real terms while maintenance capex has more than doubled from 2004 to today. Additional structural factors, such as increasing investor focus, are additional considerations and costs for companies in any development project. All of this suggests to us that further investment in growth is unlikely in the near term and thus supply growth will be limited which should support prices.

3. Expansionary monetary policy, rising inflation expectations and a weak dollar should lend further support to commodity demand and prices.

The rising value of global trade as a result of higher commodity prices leads to larger Emerging Market trade surpluses. This puts downward pressure on the dollar which reinforces higher commodity prices, creating a loop.

4. Will energy transition be the driver of the next super cycle replacing China?

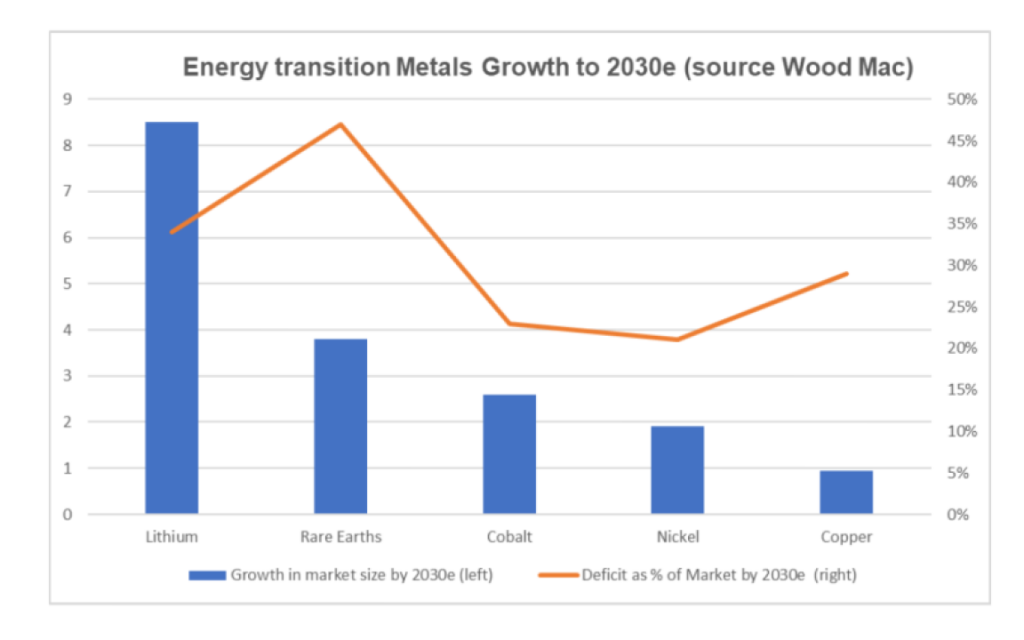

Over the long term, we see policy support driving a structural shift towards renewable energy and electric vehicles. According to Wood McKenzie, the metals directly exposed to the EV batteries including copper, lithium and rare earths are likely to experience transformational demand growth that will lead to further price upside and/or an extended period of elevated prices. Decarbonising electricity, industry and transport will require a broad set of commodities, and copper could end up being the main beneficiary. Both Europe and the US are implementing metals-intensive stimulus plans to boost demand, alongside rebounding China demand leading to potential supply issues.

Given this backdrop, we prefer exposure to metals important for future technologies, namely copper, battery metals and platinum:

Copper

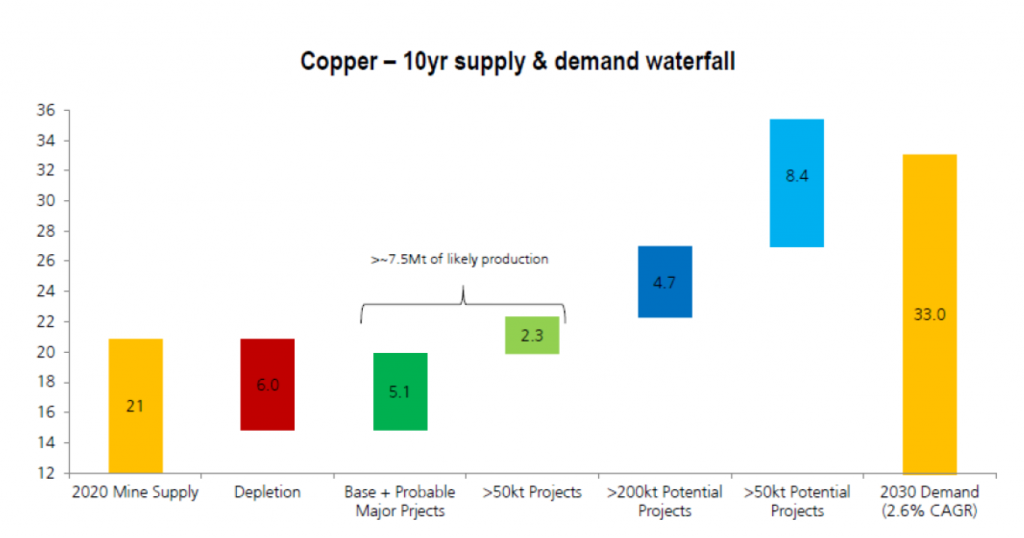

We see copper as best positioned to benefit from economic policy support across China, Europe and the US. Wood McKenzie estimates up to 3MNT of incremental copper demand from global offshore wind installations, and 5MNT from solar installations by 2030 and lastly the potential for 2.3MNT for Electric Vehicles. Copper is one of the few commodities where there is a general geological scarcity.

The chart above shows projection for mine supply compared to demand assuming just 2.6% CAGR by 2030 in line with the last 30 years average. It is unrealistic to expect these projects to all be built and run on time. Additionally, Wood McKenzie projects that electrification could accelerate demand to 3.5% or 4% CAGR by 2030. Taking both of these points into account, it is clear electrification could lead to material copper deficit resulting in a significantly higher price.

Lithium

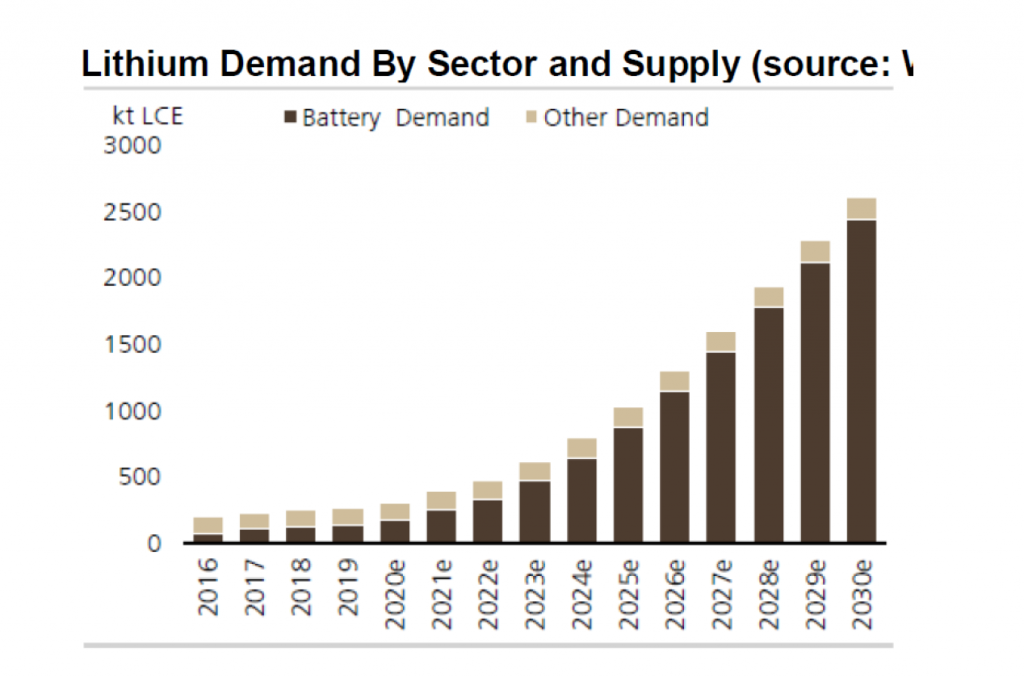

Lithium demand is expected to grow by 24% CAGR over the next 10 years with batteryrelated demand expected to lift from 35% of total demand in 2020E to 86% in 2030E.

Source: Wood McKenzie

Lithium is a pre-requisite for all current and emerging battery technologies thus Electric

Vehicle demand is not at risk from how the cathode innovation evolves. This contrasts with

cobalt which battery makers are trying to shift away from. In the medium to long term, we think supply will be challenged to keep up with the steep incline in demand driven by aggressive Electric Vehicle growth.

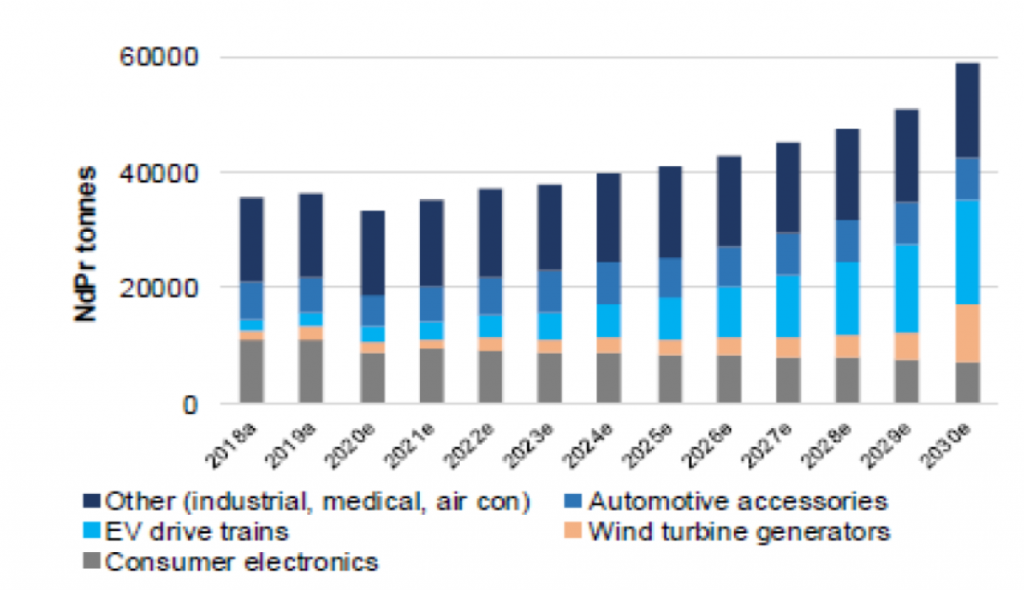

Rare Earths

There are 17 chemical elements collectively known as Rare Earths. Of these, 2 elements in particular, Neodymium (Nd) and Praseodymium (Pr) face a step change in demand from Electric Vehicle sales. Permanent magnets are the largest end use market for Rare Earths and are used in consumer electronics, auto accessories and air conditioning. They are also increasingly being used in larger applications such as Electric Vehicle drive trains and wind turbine generators. High performance magnets play a key role in electric traction motors. Estimates vary, but existing internal combustion vehicles use between 0.2 -0.7kg of NdPr per vehicle, while Electric Vehicles can use between 1-2kg.

We expect this to drive significant demand growth over the next decade.

Source: Adams Intelligence, Company reports, Conaccord Genuity estimates

We anticipate a supply gap may emerge from 2023 on a post COVID19 recovery in the auto/EV markets.

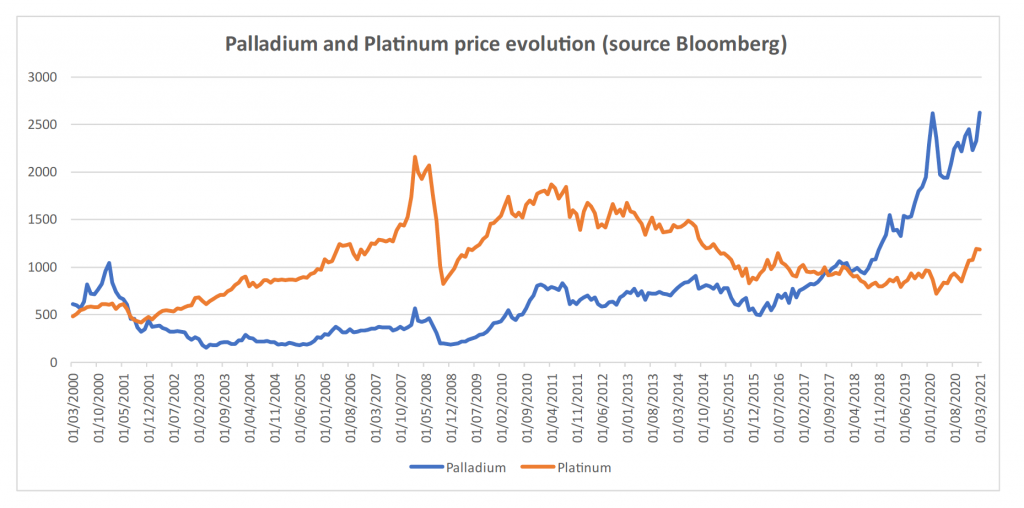

Platinum

The Platinum market currently sits in a modest surplus, and over the near term, palladium for platinum substitution in conventional ICE autocatalysts applications likely holds the key to a supply-demand improvement. Indeed, car makers are looking closely at potential opportunities to substitute some palladium with platinum without compromising their ability to meet current or future emissions limits as Palladium price increased 5x vs Platinum over the last 5 years. The combination of improving volumes and higher loadings per vehicle as a result of tightening emission standards is expected to result in double digit demand growth in 2021-22.

Over the medium term, Platinum’s role in the Hydrogen economy is crucial. It is used in fuel cells and in the electrolysis of water using renewable energy to produce green hydrogen, where it is used in conjunction with iridium as a catalyst during electrolysis. The current EU and China green hydrogen generation capacity targets alone would require, cumulatively, over 1m oz of Platinum by 2030 about 18% of current mining supply. Over the long term, the establishment of base demand from the hydrogen economy could lead to material appreciation of Platinum price taking also into account supply constraints and long lead time to build new production.

Basic Resources Sector Still Materially Undervalued:

In conclusion, while the sector is up 100% from its March 2020 lows and at its highest point since 2011, we believe there is further room to re-rate, given the supportive macro backdrop. Risks, of course, remain. If China’s economy slows materially or vaccine rollout is disrupted and delays recovery in the rest of the world, this will impact the sector in the short term at least. Changes to taxation on the mining industry could also impact projections. However, we believe that structural trends such as electrification support the medium to long term view that we remain at the beginning of a super cycle in certain commodities and commodity-related investments. Active management and depth of fundamental analysis will be required to discern which will be the long-term winners in the space.

Disclaimer

This analysis has been prepared for informational purposes only. This document does not constitute an offer or invitation to sell or buy any securities or any business or business described herein and does not form the basis of any contract. The above information should not be used for any purpose. Plenisfer Investments SGR S.p.A. has not independently verified any of the information and does not release.

No representations or warranties, express or implied, as to the accuracy or completeness of the information contained herein and the same (including their respective directors, partners, employees or consultants or any other person) shall not, to the extent permitted by law, have any liability for the information contained herein or for any omissions arising therefrom or for any reliance that either party may place on such information. information. Plenisfer Investments SGR S.p.A. assumes no obligation to provide the recipient of this document with access to further information or to update or correct the information. Neither the receipt of such information by any person, nor the information contained in this document constitutes, or will be considered as constituting, the provision of investment advice by Plenisfer Investments SGR S.p.A. to such subjects. Under no circumstances should Plenisfer Investments SGR S.p.A. and its shareholders and subsidiaries or their employees be directly contacted in relation to this information.

Plenisfer Investments SGR S.p.A.

Via Niccolò Machiavelli 4

34132 Trieste (TS)

Via Sant'Andrea 10/A, 20121 Milano (MI)

info@plenisfer.com

+39 02 8725 2960

Contact us at info@plenisfer.com

Please read the KIID as well as the Prospectus before subscribing. Past performance is no indication of future performance.

The value of your investment and the return on it can go down as well as up and, on redemption, you may receive less than you originally invested.

© Copyright Plenisfer Investments onwards 2020. Designed by Creative Bulls. All rights reserved.