This Website allows the sending only of so-called “first-party” analytic cookies to guarantee its technical functioning and to analyse aggregate data on Website visits. By closing this banner, or clicking on any element in the web page, the use of these cookies is accepted.

Oil was the best performing asset class in Jan 2021. And the worst in 2020. A perfect storm of extreme falloff in demand due to lockdowns globally, the expectation of greater demand for green energy in the future and excess supply saw oil fluctuate dramatically in 2020 in a wide $19-69/bbl range.

After the positive performance in January, oil closed with a barrel price of $ 55.9. The strong performance has continued through February with prices reaching $60 this week. What can investors expect in the future? That the positive performance continues or that a trend similar to that of 2020 is repeated?

At Plenisfer, we believe there are more reasons to be positive going forward.

1) While we don’t underestimate the medium-term impact of the ongoing move to green energy, oil prices are likely to be more dependent on the economic recovery in the near term. Therefore, the expectation of GDP growth in 2021 should be a support for oil prices.

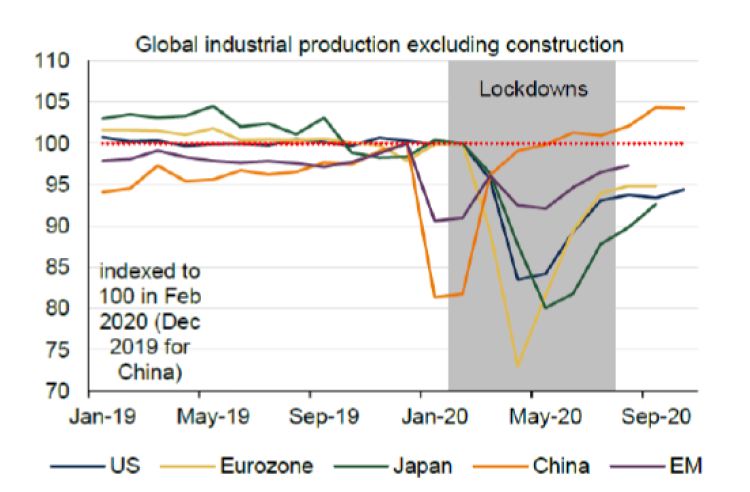

Since Q2 2020, global oil consumption has been recovering unevenly around the world. While global economic activity collapsed during the lockdown, the recovery has also been exceptionally fast. China’s industrial activity is now expanding compared to last year’s levels and other regions should soon catch up. Similarly, international trade activity also fell sharply at first, but it is now expanding at a very swift pace. While we don’t underestimate the relevance of the decarbonisation impact on medium term oil demand we are positive on the oil price trend in the near future (2021-22).

The OPEC+ cuts in 2020 and the uneven demand uptick have helped push the oil market back into deficit since 3Q20.

Source: Bloomberg

Source: Federal Reserve Board, Ministry of Economy, Trade & Industry, China National Statistics Bureau

Looking forward, we expect the current deficit to persist into 2021 on the back of a continued improvement in demand towards 2019 levels driven by recent vaccine announcements also lifting mobility trends through 2021 and 2022.

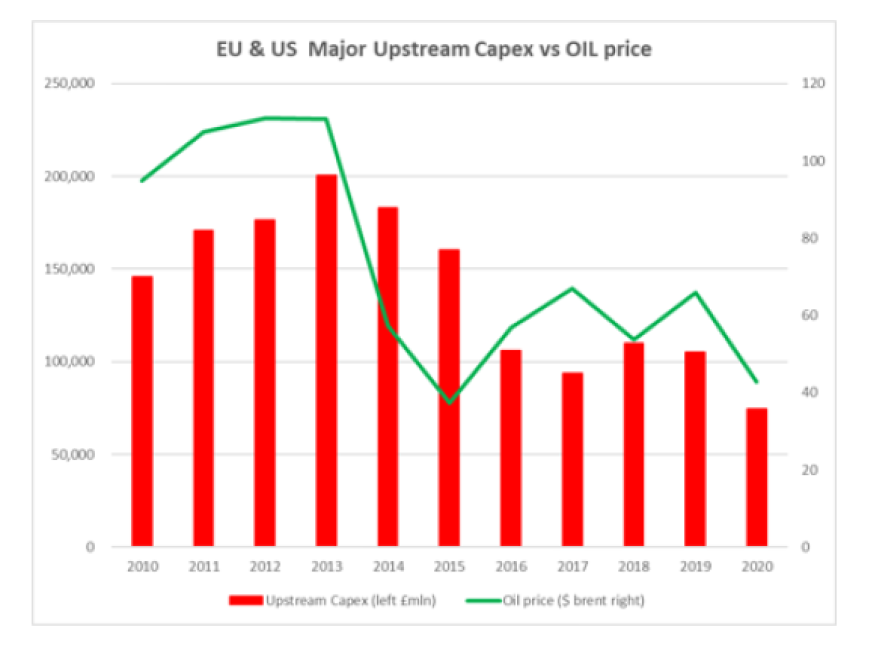

2) Supply, in the next two / three years, will be more limited due to several factors: Producers have agreed on a reduction in production in the pandemic period; US shale₁ supply has reached its peak; investments in capex for exploration and production of oil companies are in sharp decline having gone from $ 200 billion in 2013/2014 to less than $ 70 billion in 2020; the natural reduction of production capacity of existing fields (about 5/6% per year).

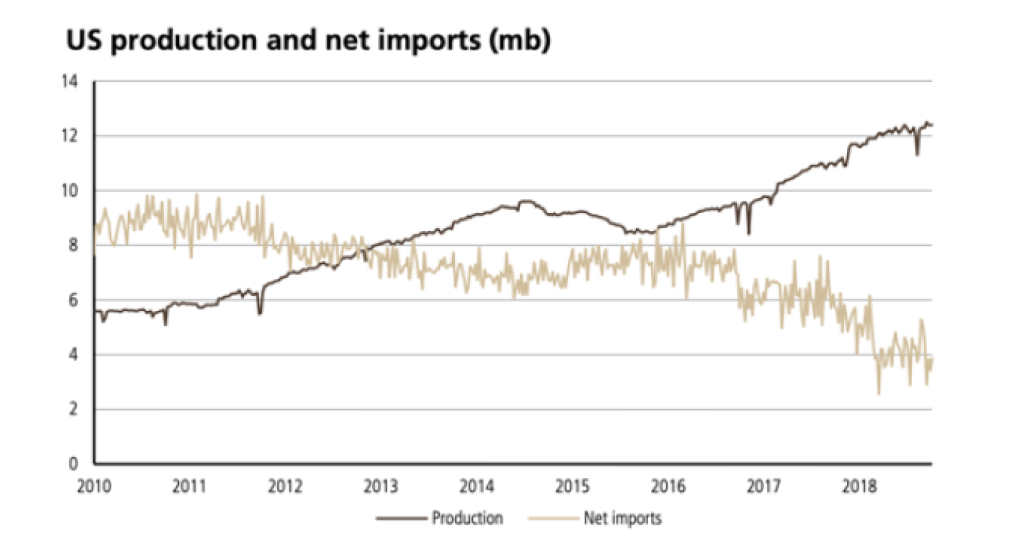

Shale₁ has enabled US production to double from 6 mb / d in 2011 to over 12 mb/d in 2019. However, by 2021 the IEA sees shale moving into maturity, with higher decline rates from a larger production base resulting in slower incremental growth. The geology of shale, with high initial well productivity and rapid decline rates (a 70% decline rate in year 1 is not uncommon), provides different growth and decline rate characteristics vs. conventional reservoirs. From 2021 about 3 mb/d of new production will be needed to keep production flat from 2019-2020 levels.

Similarly, it’s worth noting Oil majors have constantly reduced Exploration and Production capex over the last 10 years on the back of a declining oil price and more recently as they are divert an increasing amount of resources to address energy transition.

Source: IEA

Source: Company Data

3) We expect that OPEC will not increase supply or countries currently restricted due to sanctions will not re-enter the supply market in 2021. If this proves to be the case, the oil price will benefit from greater support in 2021.

This is also the greatest risk to our assumptions. Any move by OPEC to increase supply or the removal of sanctions on countries such as Iran and Venezuela could increase supply and would naturally impact our stance that oil prices are supported over the next 12-24 months.

Our overall base case scenario calls for a cyclical bullish stance for the oil price and by extension energy stocks, which trade at significant discount to their history.

Disclaimer

This analysis has been prepared for informational purposes only. This document does not constitute an offer or invitation to sell or buy any securities or any business or business described herein and does not form the basis of any contract. The above information should not be used for any purpose. Plenisfer Investments SGR S.p.A. has not independently verified any of the information and does not release.

No representations or warranties, express or implied, as to the accuracy or completeness of the information contained herein and the same (including their respective directors, partners, employees or consultants or any other person) shall not, to the extent permitted by law, have any liability for the information contained herein or for any omissions arising therefrom or for any reliance that either party may place on such information. information. Plenisfer Investments SGR S.p.A. assumes no obligation to provide the recipient of this document with access to further information or to update or correct the information. Neither the receipt of such information by any person, nor the information contained in this document constitutes, or will be considered as constituting, the provision of investment advice by Plenisfer Investments SGR S.p.A. to such subjects. Under no circumstances should Plenisfer Investments SGR S.p.A. and its shareholders and subsidiaries or their employees be directly contacted in relation to this information.

Plenisfer Investments SGR S.p.A.

Via Niccolò Machiavelli 4

34132 Trieste (TS)

Via Sant'Andrea 10/A, 20121 Milano (MI)

info@plenisfer.com

+39 02 8725 2960

Contact us at info@plenisfer.com

Please read the KIID as well as the Prospectus before subscribing. Past performance is no indication of future performance.

The value of your investment and the return on it can go down as well as up and, on redemption, you may receive less than you originally invested.

© Copyright Plenisfer Investments onwards 2020. Designed by Creative Bulls. All rights reserved.