This Website allows the sending only of so-called “first-party” analytic cookies to guarantee its technical functioning and to analyse aggregate data on Website visits. By closing this banner, or clicking on any element in the web page, the use of these cookies is accepted.

Marketing communication for professional investors in Italy

Our basic belief remains that the era of low interest rates and 2% inflation is to be forgotten. In particular, in the U.S. case, it is possible that inflation will settle in the range of 4 to 5%, as moreover shown by the PCE index - that is, inflation net of energy and food costs. In this scenario, we will have to see if the FED will continue in further monetary tightening triggering a recession or stop in raising rates to contain the cost of debt, accepting higher inflation.

At this stage of financial repression, where inflation reduces the real value of debt as well as the debt-to-GDP ratio (as long as nominal GDP growth is greater than the cost of debt), we think inflation will remain a structural economic element for years to come. The expectation of a rate cut, in our view, is not justified, even though the market always seems to expect a return to the 2009-2021 situation of price stability, rates approaching the downturn, and moderate growth.

In fact, from our point of view, it is enough to look at some inflationary factors that are not consistent with the performance recorded by the U.S. stock markets: the U.S. unemployment rate at historic lows, real wages still stationary and susceptible to calls for increases, and government spending growing strongly. Should this scenario prove to be more resilient than expected, we would have consequences for stock markets and bond prices.

On the other hand, earnings expectations still appear to be robust while the level of corporate spreads appears to be below historical highs. For risky assets, we think it is appropriate to continue to focus on those sectors where the element of structural supply scarcity is predominant (energy companies, commodities used in the energy transition) and on long-term trends such as those related to semiconductors and industrial transformation in Europe. In general, we think there will be a return focus on value stocks over growth stocks, and real assets (primarily commodities), because able to protect against inflation.

On the bond front, government bonds still provide negative real yields, with some exceptions such as in the US. Here we are likely to see both the effects of monetary policies and Quantitative Tigthening and especially to finance an already overflowing government deficit (6% of GDP) that is expected to rise further as a result of the U.S. administration's planned investments that are supposed to take government debt from the current 31 trillion to 35 over the next few years.

In fixed income, we therefore prefer credit risk to interest rate risk, and particularly the quality corporate segment in sectors with growth potential, such as energy (especially hybrid issues) and in some industrial sectors with good cash flow generation, or in financials.

Disclaimer

Fund Factsheet - Plenisfer Investments Sicav Société d'investissement à capital variable (SICAV) Luxembourg" - Destination Value Total Return ("Fund" or "Sub-Fund")

Investment Objective and Policy: The objective of this Sub-Fund is to achieve a superior risk-adjusted total return over the market cycle. The goal is value creation through risk-adjusted total return. Achieving long-term capital appreciation and underlying income through a long-term focus on valuation and market cycles is key to achieving the Sub-Fund's objectives.

Legal structure: UCITS - SICAV

Investment Manager: Plenisfer Investments SGR S.p.A.

Management Company: Generali Investments Luxembourg S.A.

Launch date: 04/05/2020 (share class EUR ACCUMULATION)

Benchmark for performance fee calculation only: SOFR Index

Subscription/Redemption process: Valuation day, 13:00 Luxembourg time (T)/ Redemption: Valuation day, 13:00 Luxembourg time (T) + 5

Minimum subscription: € 500,000 share class I; € 1,500 share class R

Currency: USD

SFDR classification: The Fund promotes, among other features, the environmental or social characteristics set out in Article 8 of Regulation (EU) 2019/2088 on sustainability reporting in the financial services sector ("SFDR"). The Fund is not an Article 9 under SFDR (does not have sustainable investment as an objective). For all information on the SFDR (Sustainable Finance Disclosure), please refer to Annex B of the Prospectus ("pre-contractual document").

The Fund is denominated in a currency other than the investor's base currency, changes in the exchange rate may have an adverse effect on the net asset value and performance.

Risk profile and inherent risks

Risk factors: Investors should consider the specific risk warnings contained in section 6 of the Prospectus and more specifically those concerning: - Interest rate risk. - Credit risk. - Equity risk. - Emerging markets risk (including China). There is no pre-determined limitation to exposure to emerging markets. Emerging market risk may therefore be high at times. - Frontier market risk. - Foreign exchange risk. - Volatility risk. - Liquidity risk. - Derivatives risk. - Short exposure risk. - Distressed debt risk. - Securitised debt risk. - Contingent Capital Securities Risk ('CoCos').

Destination Value Total Return

RISKS

Summary Risk Indicator

Its purpose is to help investors understand the uncertainties associated with gains and losses that can impact their investment.

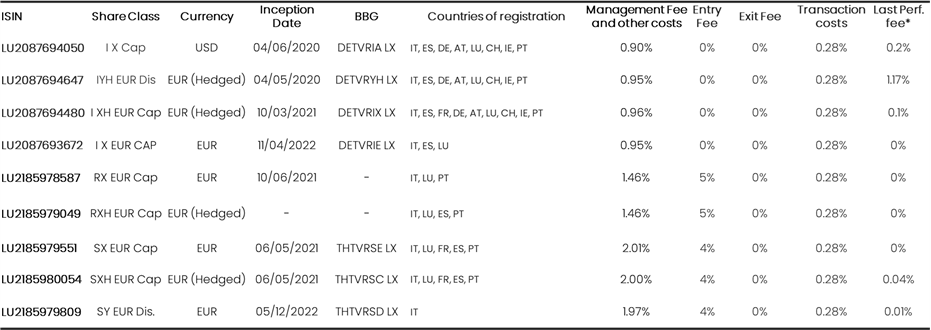

List of available share classes and fees

The performance fee is calculated according to the "High Water Mark with performance fee benchmark" mechanism with a performance fee rate of 15.00% per annum of the positive return above the "SOFR Index" (the performance fee benchmark). The actual amount will vary depending on the performance of your investment. Tax aspects depend on the individual circumstances of each client and may change in the future. Please consult your financial advisor and your tax advisor for more details. Please refer to the countries of distribution and the website of the management company to find out if a class is available in your country and for your group of investors.

(#) Based on the latest KID - May 2023.

Important information:

This marketing communication is issued jointly by Plenisfer Investments SGR S.p.A. and Generali Investments Luxembourg S.A., authorised and regulated in Luxembourg by the Commission de Surveillance du Secteur Financier (CSSF). This document is prepared for professional investors and is not intended for distribution to retail clients.

This marketing document is distributed for information purposes only and is related to Plenisfer Investments SICAV, an open-ended investment company with variable capital under Luxembourg law, qualified as an undertaking for collective investment in transferable securities (UCITS) and its sub-fund Destination Value Total Return. Before making any investment decision, you are advised to read the PRIIPs KID, the Prospectus and the annual and semi-annual reports as soon as they become available. These documents are available in English and the KID in local language on the following website: https://www.generali-investments.lu/. Please note that the Management Company may decide to terminate the agreements made for the marketing of the Sub-Fund in accordance with Article 93a of Directive 2009/65/EC and Article 32a of Directive 2011/61/EU. For a summary of investor rights and guidelines on individual or collective redress for disputes over a financial product at EU level and in the investor's country of residence, please refer to the following links: www.generali-investments.com and www.generali-investments.lu. The summary is available in English or in a language authorised in the investor's country of residence. This communication does not constitute investment, legal or tax advice. Please consult your tax and financial adviser to find out whether the Fund is suitable for your personal circumstances and to understand the associated tax risks and impacts. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

Unless otherwise stated, all information contained in this document is provided by the Investment Manager (Plenisfer Investments SGR S.p.A.) and must not be reproduced or disseminated without prior permission. Third party trademarks, copyrights and other intellectual property rights are and remain the property of their respective owners. Anyone wishing to use this information assumes the entire risk of its use.

The opinions expressed as to economic and market trends are those of the author and not necessarily those of Plenisfer Investments SGR S.p.A. The information and opinions contained in this document are for informational purposes only and do not purport to be complete or exhaustive. No reliance can be placed for any purpose on the information or opinions contained in this document or on its accuracy or completeness. The Investment Manager makes no representations, warranties or undertakings, express or implied, as to the accuracy or completeness of the information or opinions contained in this document and accepts no responsibility for the accuracy or completeness of such information or options.

The opinions expressed in this presentation should not be regarded as investment advice, security recommendations or trading recommendations. There can be no assurance that any market forecast discussed will be realised or that market trends will continue. These opinions are subject to change at any time based on market and other conditions.

Investment management involves many risks, including political and currency risks, and could result in the loss of invested capital. There can be no assurance that the Fund's investment objectives will be met or that its investment programme will be successful.

This material does not constitute an offer to buy or sell units of any investment fund or any security or service. It is directed to persons resident in the jurisdictions in which the fund in question has been/will be authorised for distribution. More specifically, the presentation is not intended for residents or citizens of the United States of America, or "U.S. Persons" as defined in "Regulation S" of the Securities and Exchange Commission under the Securities Act of 1933. The definition of "U.S. Persons" is provided below. The term "U.S. Person" refers to: (a) any natural person resident in the United States of America; (b) any partnership or corporation incorporated or registered under applicable U.S. law; (c) any estate (or "trust") whose executor or administrator is a "U.S. Person"; (d) any trust in which one of the trustees is a "U.S. Person"; (e) any agency or branch of a non-U.S. entity located in the U.S; (f) any non-discretionary account (other than an estate or trust) maintained by a financial intermediary or any other authorised representative, incorporated or (in the case of natural persons) resident in the U.S. (g) any discretionary account (other than an estate or trust) maintained by a financial intermediary or any other authorised representative registered or (in the case of natural persons) resident in the United States of America and (h) any partnership or corporation, if (1) formed under the law of a country other than the United States of America and (2) formed by a US Person primarily for the purpose of investing in securities not registered under the Securities Act of 1933. This restriction also applies to residents and citizens of the United States of America and "U.S. Persons" who may visit or access this Site while travelling or residing outside the United States of America.

Plenisfer Investments SGR S.p.A.

Via Niccolò Machiavelli 4

34132 Trieste (TS)

Via Sant'Andrea 10/A, 20121 Milano (MI)

info@plenisfer.com

+39 02 8725 2960

Contact us at info@plenisfer.com

Please read the KIID as well as the Prospectus before subscribing. Past performance is no indication of future performance.

The value of your investment and the return on it can go down as well as up and, on redemption, you may receive less than you originally invested.

© Copyright Plenisfer Investments onwards 2020. Designed by Creative Bulls. All rights reserved.