This Website allows the sending only of so-called “first-party” analytic cookies to guarantee its technical functioning and to analyse aggregate data on Website visits. By closing this banner, or clicking on any element in the web page, the use of these cookies is accepted.

Marketing communication for professional investors in Italy

Looking at the recent market events, we continue to think that the fragility of the financial system imposes a 'pause for reflection' on central banks, stuck in the dilemma between system stability and fighting inflation. In the short term, the risk of recession is growing stronger, although a possible cyclical return of inflation cannot be excluded. In this sense, allocations to gold and energy stocks continue to be crucial for an effective structural hedge of the portfolio.

On the bond front, we believe we are at the end of a rate hike cycle and this, from our perspective, defines an investment opportunity on the fixed income side in terms of government bonds and credit securities. Given the current inversion of the 10-2-year rate curve, we continue to maintain a steepening stance on it. Remaining focused on good quality investments remains a priority, however.

Considering risky assets, we think it is appropriate to remain cautious, due to the uncertainty surrounding monetary policies and the slowdown in the economic cycle. We continue to focus on those sectors where the element of structural supply shortage is predominant (energy companies, raw materials used in the energy transition). Considering current equity valuations, we think global P/Es are still high and are likely to decline for a long time - a factor driven by rising interest rates.

We continue to believe that the main macroeconomic driver in 2023 is the reopening of China: at the end of the quarter, the Chinese component within our portfolio stands at 7.2% (delta adjusted), confirming it as a relevant allocation. In fact, in these early months of 2023, we are seeing both the reopening of dialogue between the Chinese government and the Tech sector - after two years of a very restrictive control policy - and the potential for a recovery in consumption driven by the excess retail savings of around 8 trillion renminbi (compared to the previous years' average of 2 trillion renminbi), generated during previous lock-down periods.

Disclaimer

Fund Factsheet - Plenisfer Investments Sicav Société d'investissement à capital variable (SICAV) Luxembourg" - Destination Value Total Return ("Fund" or "Sub-Fund")

Investment Objective and Policy: The objective of this Sub-Fund is to achieve a superior risk-adjusted total return over the market cycle. The goal is value creation through risk-adjusted total return. Achieving long-term capital appreciation and underlying income through a long-term focus on valuation and market cycles is key to achieving the Sub-Fund's objectives. Benchmark: SOFR Index: The Fund is actively managed and references the Performance Fee Benchmark for the performance fee's calculation purpose. The Sub-fund does not use a Benchmark for investment purpose.

Legal structure: UCITS - SICAV

Investment Manager: Plenisfer Investments SGR S.p.A.

Management Company: Generali Investments Luxembourg S.A.

Launch date: 04/05/2020 (share class EUR ACCUMULATION)

Subscription/Redemption process: Valuation day, 13:00 Luxembourg time (T)/ Redemption: Valuation day, 13:00 Luxembourg time (T) + 5

Minimum subscription: € 500,000 share class I; € 1,500 share class R

Currency: USD

RISKS

Summary Risk Indicator

Fonte: Bloomberg

The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you. We have classified this product as 3 out of 7, which is a medium low risk class. This rates the potential losses from future performance at a medium low level, and poor market conditions are unlikely to impact the capacity of Generali Investments Luxembourg S.A. to pay you.

Be aware of currency risk. You will receive payments in a different currency, so the final return you will get depend on the exchange rate between the two currencies. This risk is not considered in the indicator shown above.

Main risks of the fund: Interest rate risk, Credit risk, Equity risk, Emerging markets (including China) risk, Frontier markets risk., Foreign exchange risk, Volatility risk, Liquidity risk, Derivatives risk, Short exposure risk, Distressed Debt Securities risk, Securitized debt risk, Contingent capital securities (“CoCos”) risk. Risk of capital loss: This Fund is not a guaranteed product. Investments bear risks. You may lose part or all of your initial investment. Investment may lead to a financial loss as no guarantee on the capital is in place.

The Fund promotes, among other characteristics, environmental or social characteristics as per Article 8 as per Regulation (EU) 2019/2088 on sustainability‐related disclosures in the financial services sector (“SFDR”). The Fund is not an Article 9 as per SFDR (it does not have sustainable investment as its objective. For more information about ESG Strategy and Objective, Biding elements and methodological limits, please refer to the Annex B of the pre-contractual document in the Prospectus or visit the related Sustainability web disclosureat:https://www.generaliinvestments.lu/lu/en/institutional/sustainability-related-disclosure.

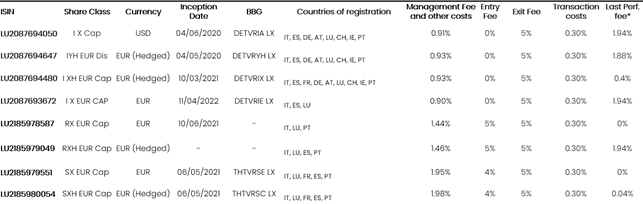

List of available share classes and fees

The performance fee is calculated according to the "High Water Mark with performance fee benchmark" mechanism with a performance fee rate of 15.00% per annum of the positive return above the "SOFR Index" (the performance fee benchmark). The actual amount will vary depending on the performance of your investment. Tax aspects depend on the individual circumstances of each client and may change in the future. Please consult your financial advisor and your tax advisor for more details. Please refer to the countries of distribution and the website of the management company to find out if a class is available in your country and for your group of investors.

(#) Based on the latest KID - January 2023.

Important Information

This marketing communication is related to Plenisfer Investments SICAV, an open-ended investment company with variable capital (SICAV) under Luxembourg law of 17 December 2010, qualifying as an undertaking for collective investment in transferable securities (UCITS) and its Sub-Fund, “Destination Value Total Return”, altogether referred to as “the Fund”. This marketing communication is intended only for professional investors in the countries where the Fund is registered for distribution, within the meaning of the Markets in Financial Instruments Directive 2014/65/EU (MiFID) and is not intended for retail investors, nor for U.S. Persons as defined under Regulation S of the United States Securities Act of 1933, as amended.

This document is co-issued by Generali Investments Luxembourg S.A. and Plenisfer Investments.

Plenisfer Investments SGR S.p.A. (“Plenisfer Investments”) is authorized as a UCITS management company in Italy, regulated by Bank of Italy - Via Niccolò Machiavelli 4, Trieste, 34132, Italia - CM: 15404 - LEI: 984500E9CB9BBCE3E272.

The Management Company of the Fund is Generali Investments Luxembourg S.A., a public limited liability company (société anonyme) under Luxembourg law, authorised as UCITS Management Company and Alternative Investment Fund Manager (AIFM) in Luxembourg, regulated by the Commission de Surveillance du Secteur Financier (CSSF) - CSSF code: S00000988 LEI: 222100FSOH054LBKJL62.

Before making any investment decision, please read the Key Information Document (KID) and the Prospectus. The KIDs are available in one of the official languages of the EU/EEA country, where the Fund is registered for distribution, and the Prospectus is available in English (not in French), as well as the annual and semi-annual reports at www.generali-investments.lu or upon request free of charge to Generali Investments Luxembourg SA, 4 Rue Jean Monnet, L-2180 Luxembourg, Grand Duchy of Luxembourg, e-mail address: GILfundInfo@generali-invest.com. The Management Company may decide to terminate the agreements made for the marketing of the Fund. For a summary of your investor rights in respect of an individual complaint or collective action for a dispute relating to a financial product at the European level and at the level of your EU country of residence, please consult the information document contained in the "About Us" section at the following link: www.generali-investments.com and www.generali- investments.lu. The summary is available in English or in a language authorized in your country of residence.

This marketing communication is not intended to provide an investment, tax, accounting, professional or legal advice and does not constitute an offer to buy or sell the Fund or any other securities that may be presented. Any opinions or forecasts provided are as of the date specified, may change without notice, may not occur and do not constitute a recommendation or offer of any investment. Past or target performance do not predict future returns. There is no guarantee that positive forecasts will be achieved in the future. The value of an investment and any income from it may go down as well as up and you may not get back the full amount originally invested. The future performance is subject to taxation, which depends on the personal situation of each investor and which may change in the future. Please liaise with your Tax adviser in your country to understand how your returns will be impacted by taxes. The existence of a registration or approval does not imply that a regulator has determined that these products are suitable for investors. It is recommended that you carefully consider the terms of investment and obtain professional, legal, financial and tax advice where necessary before making a decision to invest in a Fund.

Generali Investments is a trademark of Generali Investments Partners S.p.A. Società di gestione del risparmio, Generali Insurance Asset Management S.p.A. Società di gestione del risparmio, Generali Investments Luxembourg S.A. and Generali Investments Holding S.p.A. - Sources (unless otherwise specified): Generali Investments Partners S.p.A. Società di gestione del risparmio - This document may not be reproduced (in whole or in part), circulated, modified or used without prior written permission.

Plenisfer Investments SGR S.p.A.

Via Niccolò Machiavelli 4

34132 Trieste (TS)

Via Sant'Andrea 10/A, 20121 Milano (MI)

info@plenisfer.com

+39 02 8725 2960

Contact us at info@plenisfer.com

Please read the KIID as well as the Prospectus before subscribing. Past performance is no indication of future performance.

The value of your investment and the return on it can go down as well as up and, on redemption, you may receive less than you originally invested.

© Copyright Plenisfer Investments onwards 2020. Designed by Creative Bulls. All rights reserved.