This Website allows the sending only of so-called “first-party” analytic cookies to guarantee its technical functioning and to analyse aggregate data on Website visits. By closing this banner, or clicking on any element in the web page, the use of these cookies is accepted.

Marco Mencini, Senior Portfolio Manager Equity di Plenisfer Investments SGR

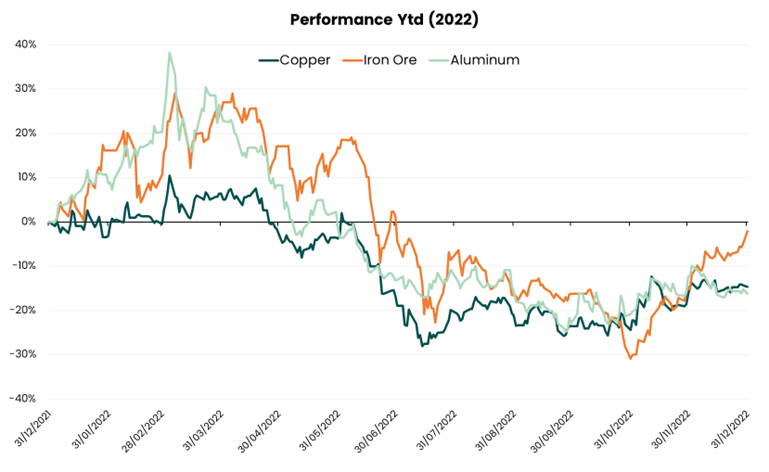

In 2022, valuations of the main industrial metals, such as copper and aluminum, have generally suffered from the slowdown in China's economy – which alone accounts for 50% of their global demand [1] – and the strengthening of the US dollar, the currency traditionally used to trade them.

Source: Bloomberg

Despite this backdrop, the Metal & Mining global index, which represents the mining equity sector, rose 8.5% in 2022, outperforming the global equity market, down -18.5%.[1]

In Plenisfer we believe that this gap, at first sight surprising, is attributable not only to the strong balance sheets of mining companies but, above all, to the peculiar dynamics of supply and demand for metals which moreover still appears significantly underestimated by the market.

We therefore have a positive view on the mining industry, which is driven by two factors: the supply shortage and demand to come back.

1. Supply shortage

The supply of metals is particularly limited and its scarcity still seems to be underestimated by the market. The supply constraints are a consequence of the fiscal austerity policies adopted by the main mining companies over the past 10 years. The disciplined allocation of capital was considered by the market to be fundamental for mining companies credibility and this led to shrinking investments for discovery and development of new mining ores. As a result, today, even companies that would like to increase the offer, see their pipelines largely already exhausted. On the other hand, to get the authorizations for the development of new projects has become harder than in the past (and impossible in some regions), as well as geopolitical risks and the impact of inflation on capital costs discourage new investments.

At the end of 2022, global mining majors revised down production expectations, with large cuts expected in 2023 of 5-10%, particularly for iron and copper. With global production of the main industrial commodities falling by 2-5% in 2022, new estimates for supply growth over the period 2018-2023 print at zero, while inventories have declined over time and appear remarkably low today, especially copper stocks.[2]

Looking in detail at copper, in the last three years the top5 miners have all recorded a net decline in production volumes of between -2% and -8%. Chile, the top1 country for volumes, is down by about 5% YTD[3], due to the impact of Covid on the supply chain and production, structural decline in the productivity of mining sites and other operational challenges. At Plenisfer we estimate that the refined copper deficit could reach 2.5 million tonnes per year by 2030.

The supply of aluminum and steel has also fallen due to the decline in productivity of European smelters, under pressure from rising electricity prices, and we do not expect them to resume full operation until the energy crisis has been resolved sustainably. This, according to EU guidelines, may not happen until 2025/26.

On the aluminum front, the impact of sanctions on Russian producers - who generate about 6% of the global market, largely (37%) destined to the European market - must also be carefully monitored[4]. If sanctions materialize, it may be difficult to place Russian aluminum units in Western markets; at the same time, a redirection of the entire trade flow can also be somewhat difficult because, for example, China is self-sufficient.

At Plenisfer we estimate that the primary aluminum deficit could reach 5.4 million tons per year by 2030 if the production limit of 45 million tons/year in China comes into force.

In conclusion, the main metals markets (copper, aluminium) are in structural deficit and although we expect a modest rebound in supply in 2023, a number of factors will continue to limit supply in the medium term. Among these:

· the regulatory and fiscal uncertainty in the main mining regions (Chile, Peru, Australia);

· longer time to get license to mine by authorities and to build projects, quintupled over the decade;

· higher energy costs;

· the increasingly frequent interruptions of activities due to adverse weather conditions or,

· due to civil unrest: for example, Las Bamba, the largest copper mine in Peru and the fifth in the World, now operates at 40% of its capacity, as stated by MMG, the company that controls it.

2. Expected growing demand

Metal supply and inventories are declining while there are structural drivers (such as decarbonisation), as well as cyclical ones, that could support demand for them in the long term.

At Plenisfer we believe that demand can grow driven by the energy transition that will support in particular the metals related to it, such as copper. On this front, one of the top three global producers, Glencore CMD, has recently sounded an alarm: "we need a price of $ 15,000 per ton compared to the current 8,500 to stimulate sufficient production to cover the needs of energy transition".

But above all, the growth in demand for 2023 will be driven by the likely restart of China. This should compensate the expected slowdown in the US economy, which represents about 20%[5] of the demand for metals.

Looking in detail at China, demand for raw materials has been very weak in the last year due to the lockdowns, but above all due to the decline in the real estate market, a critical sector for steel and other metals. We estimate that Chinese real estate directly accounts for about 35% of global seaborne iron ore demand and 12-15% of global copper and aluminum demand.

Although the weakness of the housing market remains a critical issue - as we believe it is a structural decline rather than a cyclical one - policies in this sector, as well as those directed to fight Covid, have recently highlighted the intention to give greater priority to economic growth.

Our basic assumption is that real estate development will continue to slow, but at a more moderate pace than in 2022. We estimate that the demand for metals generated by real estate will decline at a rate of 10% per year for the next three years before stabilizing. However, we expect consumer spending, production and investment in non-real estate infrastructure to improve during 2023, more than offsetting the impact of the real estate slowdown in metals markets, although Chinese steel demand is likely to continue to be weak.

Conclusion

In conclusion, at Plenisfer we believe that the expected structural restart of demand for metals in the long term will not see a corresponding increase in supply for several years, in light of the constraints to which it is subject and the scarcity of stocks.

Under such a scenario, metal prices will remain under pressure, and a bullish momentum should therefore be generated, which, after the decline of 2022, should accelerate the recovery of value to a higher growth rate than in previous phases of economic restart.

This thesis has already found a first confirmation in January during which some industrial metals recorded value growth of over 10%: the price of copper went from $ 8,500 per ton at the end of the year to about $ 9,500 per ton, while aluminum grew from $ 2,368 per ton to $ 2,613 per ton.

Our expectation of a gradual recovery of the Chinese economy is a key component of our positive 12-month view on the metals sector – particularly for those related to the energy transition such as copper – and is therefore the main risk factor to monitor.

Disclaimer

This analysis has been prepared for informational purposes only. This document does not constitute an offer or invitation to sell or buy any securities or any business or business described herein and does not form the basis of any contract. The above information should not be used for any purpose. Plenisfer Investments SGR S.p.A. has not independently verified any of the information and does not release.

No representations or warranties, express or implied, as to the accuracy or completeness of the information contained herein and the same (including their respective directors, partners, employees or consultants or any other person) shall not, to the extent permitted by law, have any liability for the information contained herein or for any omissions arising therefrom or for any reliance that either party may place on such information. information. Plenisfer Investments SGR S.p.A. assumes no obligation to provide the recipient of this document with access to further information or to update or correct the information. Neither the receipt of such information by any person, nor the information contained in this document constitutes, or will be considered as constituting, the provision of investment advice by Plenisfer Investments SGR S.p.A. to such subjects. Under no circumstances should Plenisfer Investments SGR S.p.A. and its shareholders and subsidiaries or their employees be directly contacted in relation to this information.

[1] Source: Bloomberg

[2] Source: Wood McKenzie

[3] Source: Codelco, Chilean mining company

[4] Fonte: Wood McKenzie

[5] Source: Wood McKenzie

Plenisfer Investments SGR S.p.A.

Via Niccolò Machiavelli 4

34132 Trieste (TS)

Via Sant'Andrea 10/A, 20121 Milano (MI)

info@plenisfer.com

+39 02 8725 2960

Contact us at info@plenisfer.com

Please read the KIID as well as the Prospectus before subscribing. Past performance is no indication of future performance.

The value of your investment and the return on it can go down as well as up and, on redemption, you may receive less than you originally invested.

© Copyright Plenisfer Investments onwards 2020. Designed by Creative Bulls. All rights reserved.