This Website allows the sending only of so-called “first-party” analytic cookies to guarantee its technical functioning and to analyse aggregate data on Website visits. By closing this banner, or clicking on any element in the web page, the use of these cookies is accepted.

Marco Mencini, Senior Portfolio Manager Equity di Plenisfer Investments SGR

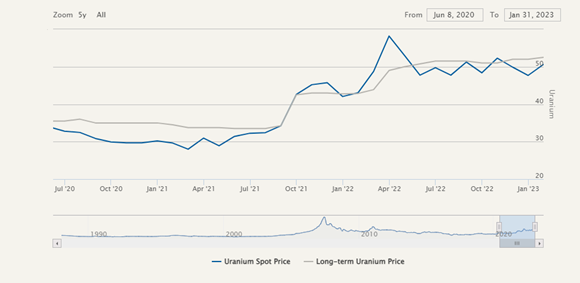

The question we asked in a commentary of 2021 dedicated to uranium (U308) was whether the time had come for the 'U', i.e. a bullish phase after years of slowing demand that had kept the price between $20 and $25 per pound for a decade, far from the spike of $150 reached in 2007.

At Plenisfer, we estimated that the price of uranium could exceed the production cost of about $50 per pound by 2025, reaching about $60 per pound.

Today we believe that this target could be reached by the end of this year.

Source: Cameco

Supporting this thesis is, and continues to be, the peculiar dynamics of supply and demand, the former supported by a series of structural trends, such as decarbonisation, the latter severely constrained and expected to decline further.

This dynamic is not only confirmed today, but further strengthened in 2022.

On the demand side, the invasion of Ukraine and geopolitical tensions with Russia have increased concerns about the security of supply and generated, like for many other energy commodities, a temporary peak in the uranium price of almost $60 per pound, reached last April. After the invasion, the price was particularly supported by concerns about transport, since the main channel of uranium exports from Kazakhstan (which accounts for 40% of production) passed through the port of St. Petersburg. The creation of an alternative trans-Caspian export route that does not pass through Russia has eased these fears and brought the price of uranium back to around $50 per pound (Source UxC).

Also in 2022, nuclear power was included in the European Union's taxonomy of sustainable energy sources, a decision that should support further demand for uranium.

The renewed interest in nuclear power has, more generally, led to the planning of new plants in several countries: about 100 power reactors are planned, mostly in Asia, and another 300 are under consideration. Furthermore, fourth generation power plants are being studied which envisage small modular reactors. The EU is co-financing an experimental nuclear fusion project, Iter, with the aim of generating waste-free nuclear power by 2035 and making it more sustainable both from an environmental and economic point of view. Meanwhile, the US Department of Energy announced that, for the first time in history, a nuclear fusion process has produced more energy than was used to trigger the reaction. This is a sensational news, but it should be remembered that any large-scale use of fusion will take decades.

On the supply side, beyond the peculiar dynamics of 2022, there is a structural shortage.

The main players, in light of low uranium prices and rising extraction costs, have reduced their investments in exploration and production by over 80% in the last decade (source: S&P Global Market Intelligence). Production also appears to be highly concentrated both geographically, with most of the production in Kazakhstan (41%), and in terms of operators, with around 70% of primary production in the hands of the top five producers (source: World Nuclear Association, "WNA").

In the last 10 years, about 30% of uranium has been derived from secondary supplies, which are essential to cope with supply shortages. It is very difficult to estimate the amount of available stocks due to the commercial secrecy of operators, however, some estimates place it at 1.3 billion pounds (source: WNA), a potentially insufficient supply compared to expected demand. It should also be considered that most of these stocks are held by public operators (53%) and governments (34%) (source: WNA) and that only a relatively small part of these stocks can be considered "sellable" as they are mostly held for strategic reasons.

Despite the supply contribution that may come from the restart of several uranium mines (McArthur River, Langer-Heinrich, Lost Creek, Rosita, etc.), a persistent shortfall of 15-30 million pounds per year is still estimated, including secondary supply. In Plenisfer we believe that this shortfall will persist at least until new NXE mine becomes operational (2030) and/or until spot and forward prices rise significantly to $75 a lb, respectively and at $85 a pound.

In this context, in 2023 the supply of uranium is expected to record its seventh consecutive year of deficit, estimated at about 42 million pounds, against a primary demand of approximately 180 million pounds.

From Underfeeding to Overfeeding: The Crucial Factor in the Uranium Bull

In the last year, since the start of the invasion of Ukraine, the spot price of uranium has increased by around 15% and is now around $50 per pound. In the same period, the spot price of enriched uranium has increased by around 150%, from around $40 to over $110 per pound. It is therefore on the latter that the geopolitical "risk premium" was fully reflected on the price.

Buyers of enriched uranium, i.e. utilities, have rushed to buy enriched uranium because, while Russia is relatively marginal in uranium production (14%), it remains crucial for the rest of the nuclear fuel cycle by providing approximately 27% of enriched uranium (Source: UxC).

New enrichment facilities will become operational in the United States and Europe by mid-2023, with the aim of reducing energy dependence on Russia, which should trigger further demand and support the price of enriched uranium.

The question to ask today, in our opinion, is whether the price of uranium will follow the growth trajectory of that of enriched uranium.

At Plenisfer we believe that there is a mechanism through which the increase in the value of enriched uranium could be reflected in the price of uranium, even if not immediately.

This mechanism is the transition from underfeeding to overfeeding.

When uranium prices are high, uranium enrichers are incentivized to use less, which implies longer times to provide the same amount of enriched uranium output ("underfeeding").

When prices of enriched uranium are high, assuming that the price of uranium does not move in tandem, the incentive shifts to overfeeding, i.e. supplying more uranium input in order to shorten the enrichment times and therefore take advantage of higher prices ("overfeeding").

Today we are therefore in this phase of "overfeeding" which in our opinion creates a source of secondary demand for uranium by the enrichers, destined to support its price.

This thesis already seems to be proved by the markets: since the beginning of the year, while the enriched uranium prices were substantially stable (-1%), uranium prices have risen by +5% (source: UxC).

We expect this trend to continue and, in light of all the factors described, we therefore confirm our structurally positive view on uranium.

Disclaimer

This document relates to Plenisfer Investments SGR S.p.A. ("Plenisfer Investments") and is not a marketing communication relating to a Fund, investment product or investment services in your country. This document is not an offer or invitation to sell or buy any securities or any business or enterprise described herein and does not form the basis of any contract.

Any opinions or forecasts are provided in addition to the date specified, are subject to change without notice, do not predict future results and do not constitute a recommendation or offer of any investment product or service. Past performance is not a guide to future returns. There can be no assurance that an investment objective will be achieved or that there will be a return on capital. This document is addressed exclusively to professional investors in Italy pursuant to the Markets in Financial Instruments Directive 2014/65/EU (MiFID II). It is not intended for retail investors or US Persons, as defined in Regulation S of the United States Securities Act of 1933, as amended.

The information is provided by Plenisfer Investments authorized as a UCITS management company in Italy, regulated by the Bank of Italy - Via Niccolò Machiavelli 4, Trieste, 34132, Italy - CM: 15404 - LEI: 984500E9CB9BBCE3E272.

All data used in this document, unless otherwise indicated, is provided by the company. This material and its contents may not be reproduced or distributed, in whole or in part, without the express written consent of the company.

Plenisfer Investments SGR S.p.A.

Via Niccolò Machiavelli 4

34132 Trieste (TS)

Via Sant'Andrea 10/A, 20121 Milano (MI)

info@plenisfer.com

+39 02 8725 2960

Contact us at info@plenisfer.com

Please read the KIID as well as the Prospectus before subscribing. Past performance is no indication of future performance.

The value of your investment and the return on it can go down as well as up and, on redemption, you may receive less than you originally invested.

© Copyright Plenisfer Investments onwards 2020. Designed by Creative Bulls. All rights reserved.